News

Created on 15.07.2025

Building, Housing, Homeownership: What Are the Plans of the New Federal Government?

In recent years, sharply rising costs, high building standards, and lengthy planning and approval procedures have led to many construction and renovation projects being delayed or canceled altogether. The new federal government wants to change that and launch a “housing construction turbo”: building should become faster, easier, and above all, cheaper. Several changes to the Building Code are planned, along with a restructuring of financial subsidies. The controversial heating law is also under review.

Relaxed Standards: Building Type E

Subsidies and Financial Support

Abolishing the Heating Law

New Impulses for House and Apartment Construction

Created on 27.11.2024

Reduce heating costs: The 5 most effective heating tips for the winter

Tip 1: Ventilate properly

Correct ventilation can save you up to €190 a year on heating costs.

Tip 2: Electronic thermostats

Electronic thermostats can save you around €170 a year. However, you also have to reckon with an initial cost of €15 to €70 per thermostat.

Tip 3: Lower temperatures by 1° C

Tip 4: Insulate windows and doors

Tip 5: Keep radiators clear & ventilate

As you can see, it is not difficult at all to reduce heating costs. Many of the effective tips in this article can be implemented free of charge, while others can be realised with just a few euros.

Created on 07.10.2024

Floor plan planning: So many decisions, where do I start when building a house?

Event highlights:

- Floor plan planning: recognising and naming needs

- 10 questions to help you decide YOUR perfect floor plan

- Experiences of Town & Country Haus builders

Event details:

Register now for free and without obligation here. We look forward to your participation!

We will be happy to answer any questions you may have in the run-up to the event. Simply contact us via our contact form.

Created on 10.09.2024

Turnkey construction: Your path to carefree home ownership

help you understand these terms and make the best decision for your building project.

Event highlights:

- Definition and differences between the expansion stages: Find out what work and services are included in the various

expansion stages are included. - Advantages of a turnkey house: Understand why a turnkey house can save time and money.

Event details:

Register now for free and without obligation here. We look forward to your participation!

We will be happy to answer any questions you may have in the run-up to the event. Simply contact us via our contact form.

Created on 08.06.2024

Saving money when building a house: Tricks to reduce interest rates

#1 Sustainably thought out: The right planning for your new building

With a flexible floor plan and a compact design, you also benefit from more living space in fewer square meters. This means you can adapt your new home to your wishes and needs. Thanks to the reduced, effectively used living space, you also lower your interest rates.

#2 Self-help when building a house

#3 Ease your own wallet with government subsidies

KfW funding for climate-friendly new buildings (BEG-KFN)

By the way: All solid houses from Town & Country Haus meet the requirements of the energy-efficient KfW subsidy. Our residential buildings already meet the standard of an Efficiency House 55 (EH55).

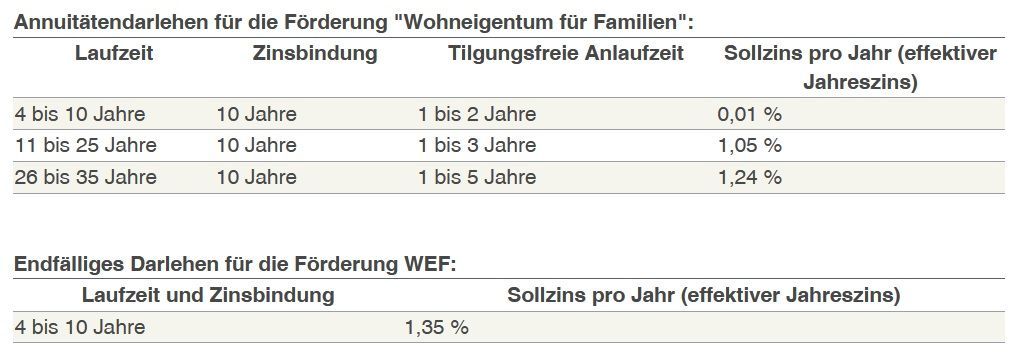

Successor to the child home building allowance: Home ownership for families (WEF)

All families with at least one minor child and an income limit of 90,000 euros can apply for this subsidy. With each additional child, the income limit increases by 10,000 euros.

#4 Double funding thanks to granny flats or tiny apartments

Created on 07.03.2024

Financing your own home – How to do it with financing services

Benefits of the funding and financing service

And the best part: Our more than 250 regional Town & Country Haus partners can advise you on your financing directly on site. At Town & Country Haus, you can get everything from a single source: house, plot of land and financing. We look forward to your house project!

Created on 23.11.2023

Building a house with funding – affordable, future-proof and flexible

The Federal Funding for Efficient Buildings - Climate-Friendly New Construction (BEG KFN) supports house construction in two funding levels: climate-friendly residential building (KWFG) and climate-friendly residential building with QNG (KWFG-QNG). And the best thing: subsidized loans are available per residential unit.

House with granny flat: double funding

The monthly installments are just as important to us as they are to you, which is why our independent funding and financing service accompanies you from the beginning so that you can fulfill your dream of owning your own home. With this funding level, you can invest around 200,000 euros in subsidized loans in your dream home with a monthly installment of 900 euros. In combination with an additional bank loan, you can cover the remaining costs of building your house, such as land and additional construction costs. At first glance, that sounds too good to be true, but we have created a financing example for the Flair 148 growing house with a granny flat for you here to give you a better overview of the funding.

The advantages: House with granny flat

Created on 02.08.2023

Real estate prices are falling: Why it's worth buying a house now

Where real estate is now cheap

Housing is still the most expensive in Germany's seven major cities - Berlin, Hamburg, Munich, Cologne, Düsseldorf, Stuttgart and Frankfurt: the purchase price for a property here is on average a good 6,000 euros per square meter. But the price decline is also noticeable in the cities with a population of one million, according to the property price index. At 1.4 percent, however, it is moderate. What might be surprising is that buying a house in the suburbs of the country's largest metropolises is often not worth it. Property prices here are higher than in the big cities themselves.

What will happen to real estate prices?

According to the expert, the trend is likely to continue downward in the coming quarters. Reason enough to start looking for your dream property in good time. Also because the interest rates on real estate loans are currently stable and drastic interest rate cuts are not in sight.

Is it better to build or buy now?

Created on 05.06.2023

Home ownership for families: The child home building allowance 2023

Family support: The prerequisites

- Families with at least one minor child and an annual income of 60,000 euros

- 10,000 euros more annual income for each additional minor child living in the household

- Funding a new building for personal use

Which residential buildings are subsidized?

How is funding provided?

*Source: Kreditanstalt für Wiederaufbau (KfW)

Created on 18.04.2023

How to make your home burglar-proof

5 tips for your safe home

1. Property security

2. Outdoor lighting

3. Surveillance cameras

4. Burglar-resistant doors

5. Alarm systems

Created on 09.03.2023

Built for you – our new expandable Town & Country houses

Our ForYou

Build a semi-detached house for you

The open living area with living room and kitchen, utility room and guest toilet is located on the ground floor. The U-shaped staircase connects the two floors and allows you to enter the light-flooded gallery on the upper floor. There is also space here for a bathroom, bedroom and children's room. Depending on your situation, you can expand the attic and create additional space.

Expandable attic

Created on 09.11.2022

Fully equipped: What do builders really need?

Building a house is becoming more and more expensive. The reason for this is not only the increased price of building materials, but also the increased demands of the builders: the new house should be as energy efficient as possible and state-of-the-art. This makes it all the more important that the pre-determined budget is not exceeded. However, the results of current studies paint a different picture: around three-quarters of all private builders pay significantly more for their home than originally planned.

What is included?

Can I treat myself to that?

Everything has been thought of: Fully equipped at Town & Country Haus

The basic inventory also includes a fully equipped bathroom with a floor-level shower, a separate guest bathroom depending on the type of house, easy-care interior doors, a high-quality wooden staircase and clever building technology. Builders who opt for a turnkey solid house only have to do the wallpapering and flooring work, then it's time to move in and feel good!

Created on 02.06.2022

Property tax reform – what awaits property owners?

The property tax is one of the oldest taxes in Germany. The tax authorities use it to tax real estate – regardless of whether it is just a small plot of land or a large residential property.

Why is a reform of the property tax needed?

When does the new property tax come into effect and what changes?

What do owners need to do now?

What data is required?

Created on 16.02.2022

This is how electricity price developments affect your household

The price of electricity in Germany is 31.8 cents per kilowatt hour (kWh) and ranks second among international electricity prices. The reasons for the price development are demand, production, purchase price, low competition and the network fee that electricity providers have to pay to the network operators. The aim is to reduce the EEG levy (Erenewable-Energies-Gnot only to reduce the tax burden (eStetz) but to abolish it in the long term.

How is the electricity price calculated?

The price of electricity for your own home is made up of three cost blocks. The state sets the taxes, duties and levies that make up half of the price of electricity. These are the value added tax and electricity tax, the concession fee and the EEG levy. A quarter of the price of electricity is regulated by law with the network fee and the costs for the meter in the second cost block. Electricity generation, transport and distribution is the third and smallest component that is not set by the state.

Factors influencing electricity consumption

Since March 1, 2021, electrical appliances such as dishwashers, washing machines, combined washer-dryers, refrigerators and freezers, televisions and monitors have been available according to classifications A to G. This is because household appliances can drive up electricity costs; the top 5 power guzzlers are old heating pumps, electric stoves, freezers, refrigerators and lighting. Other power guzzlers that are often forgotten are standby mode and charging cables that remain in the socket even though no device is connected. The better the energy efficiency class of your electrical appliance, the less electricity you use.

Photovoltaic system for personal use

Created on 24.01.2022

Equip your home with a digital electricity meter - What you need to know

What is the difference between a digital electricity meter and a smart meter?

Most households have a digital electricity meter, also known as a modern measuring device, installed. This is a simple electric meter that displays not only the current meter readings but also daily, weekly, monthly and annual electricity consumption values. Since it is not connected to the Internet, it cannot be read remotely and consumption values cannot be transmitted.

Intelligent measuring systems, so-called smart meters, are equipped with a communication module (smart meter gateway). This enables data transmission in two directions: Smart meters can both send and receive data.

Who gets a smart meter?

- Households with a high electricity consumption of over 6,000 kWh per year. The decisive factor is the average electricity consumption of the last three years.

- Owners of electricity generating systems (such as photovoltaic systems) with a nominal output of more than 7 kW. For new systems with a nominal output between 1 and 7 kW, the meter operator decides.

- Households with a controllable consumption device (e.g. a heat pump or night storage heater), provided that control has been agreed with the network operator.